BIP 2019

For the 8th time, Technologiestiftung Berlin commissioned the Leibniz Centre for European Economic Research (ZEW) to acquire empirical data on the innovation-related activities of Berlin’s economy. The full report on the 2019 Berlin Innovation Panel is available here. The report is based on data from 1,723 companies from industrial and selected service sectors in Berlin.

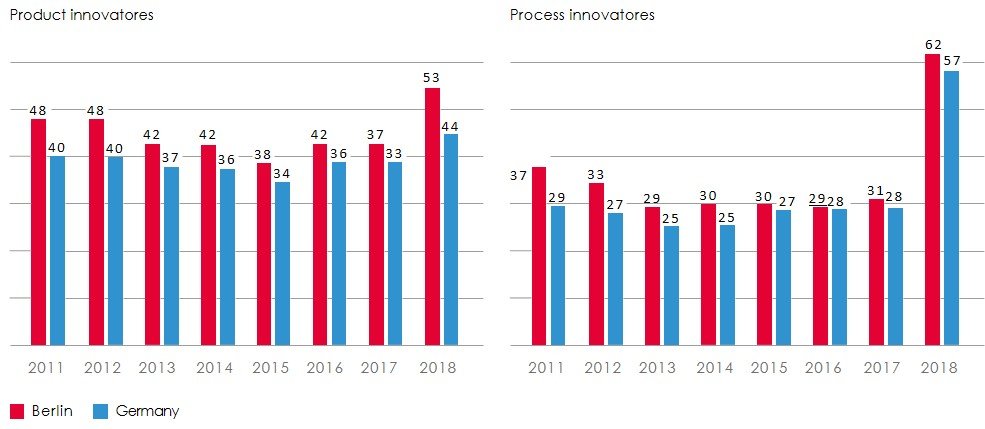

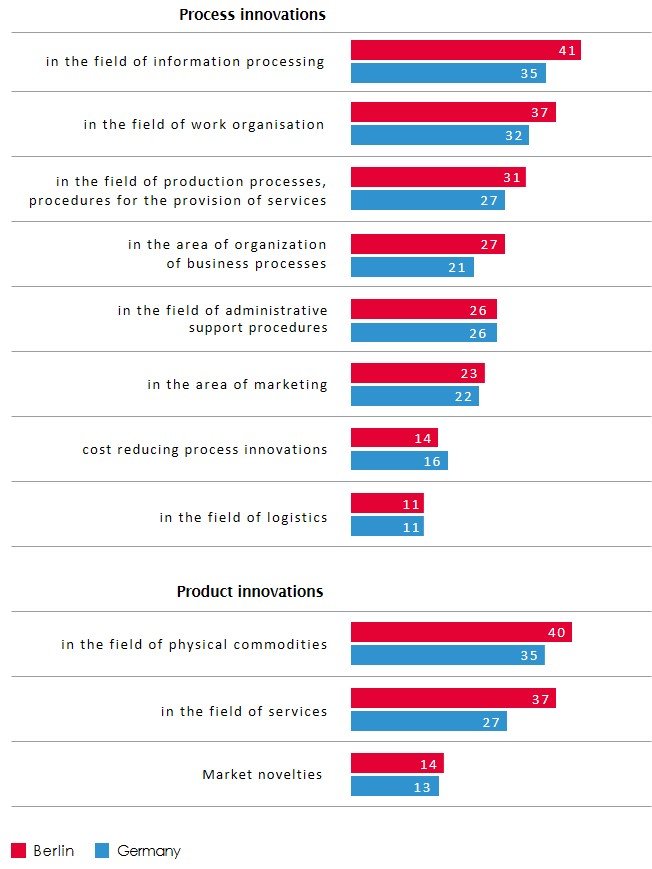

A change in the survey methodology makes it possible to better record measures for the implementation or intensification of digitalization. However, this makes it more difficult to evaluate the data over time. For Berlin as well as for Germany, the improved data collection on digitization leads to the reporting of strongly increased spending on innovation. In terms of innovation intensity, it has caused the Berlin economy's lead over the German average to rise even more significantly. A quantitative differentiation of the shares of the reported growth between additionally recorded digitization activities and intensified innovation activities is not possible ex-ante. The fact that the companies prioritized digitization and product innovations over cost reduction during the reporting period is clearly evident (fig. 2).

Berlin’s innovation intensity is again above average:

- An absolute increase of 785 million euros to 4.65 billion euros in innovation expenditures by Berlin’s companies was recorded.

- This is a more rapid increase in comparison to the previous years and in national comparison.

- This increase is mainly driven by two sectors which are dominated by large corporations ( <250 employees).

- SMEs are again more innovation-intensive than the national average and large local companies.

- The major share of innovation expenses is spend by Berlin’s large companies. When looking at sectors, the industrial sector is responsible for the main share.

- The share of the service sector in Berlin's innovation activities has risen to over 30% (Germany: <20%)

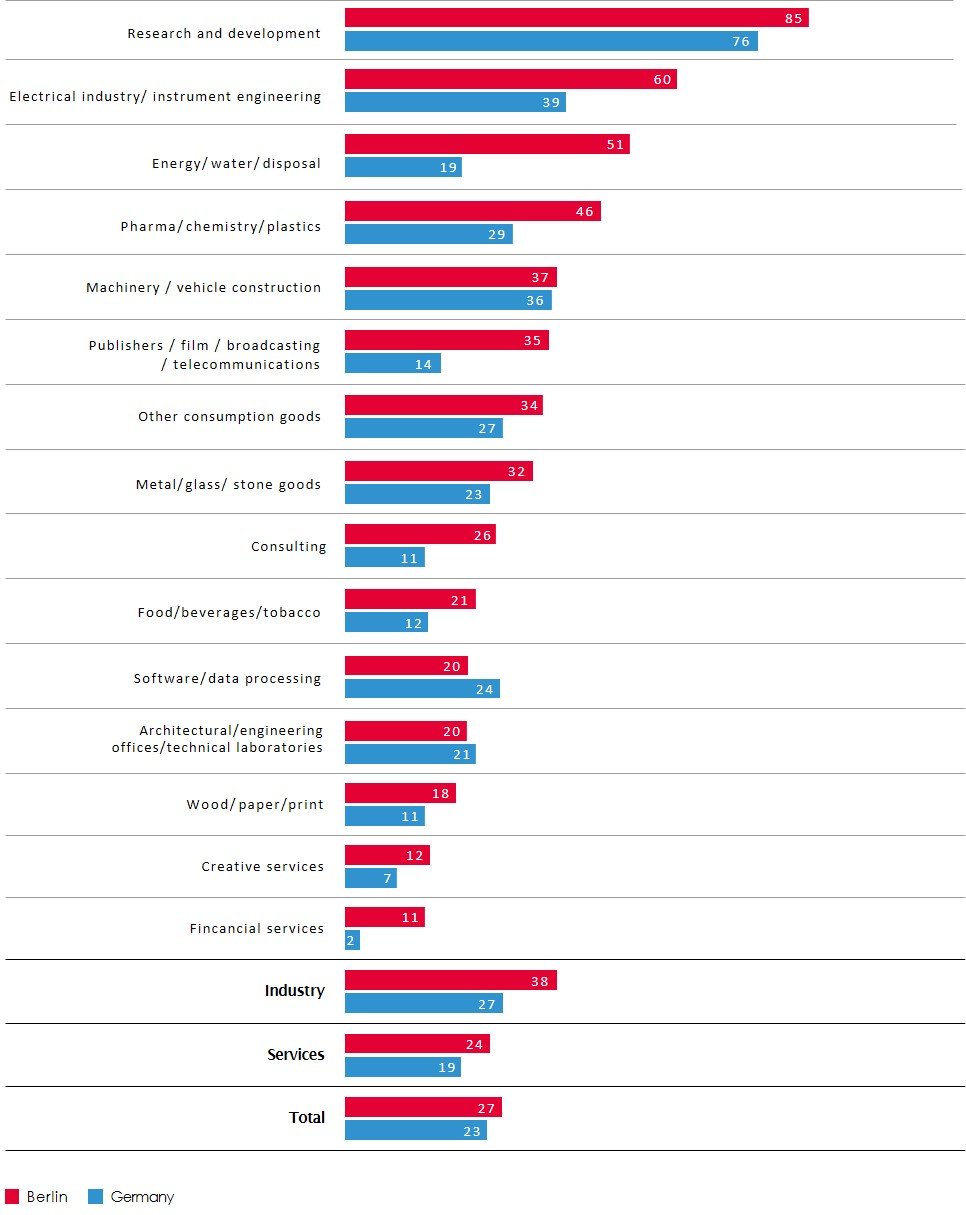

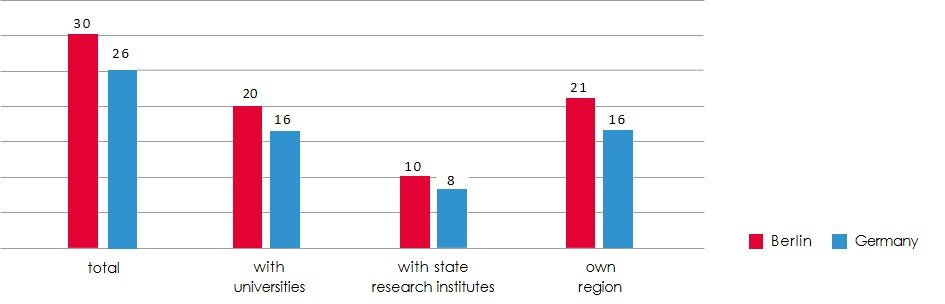

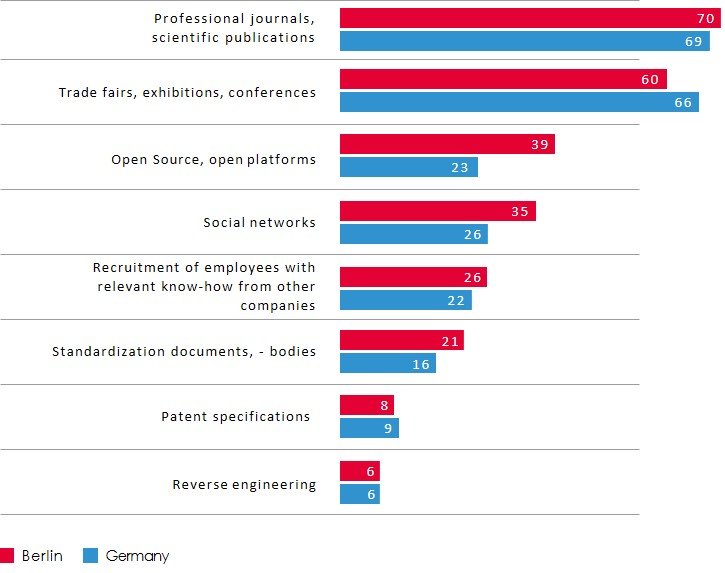

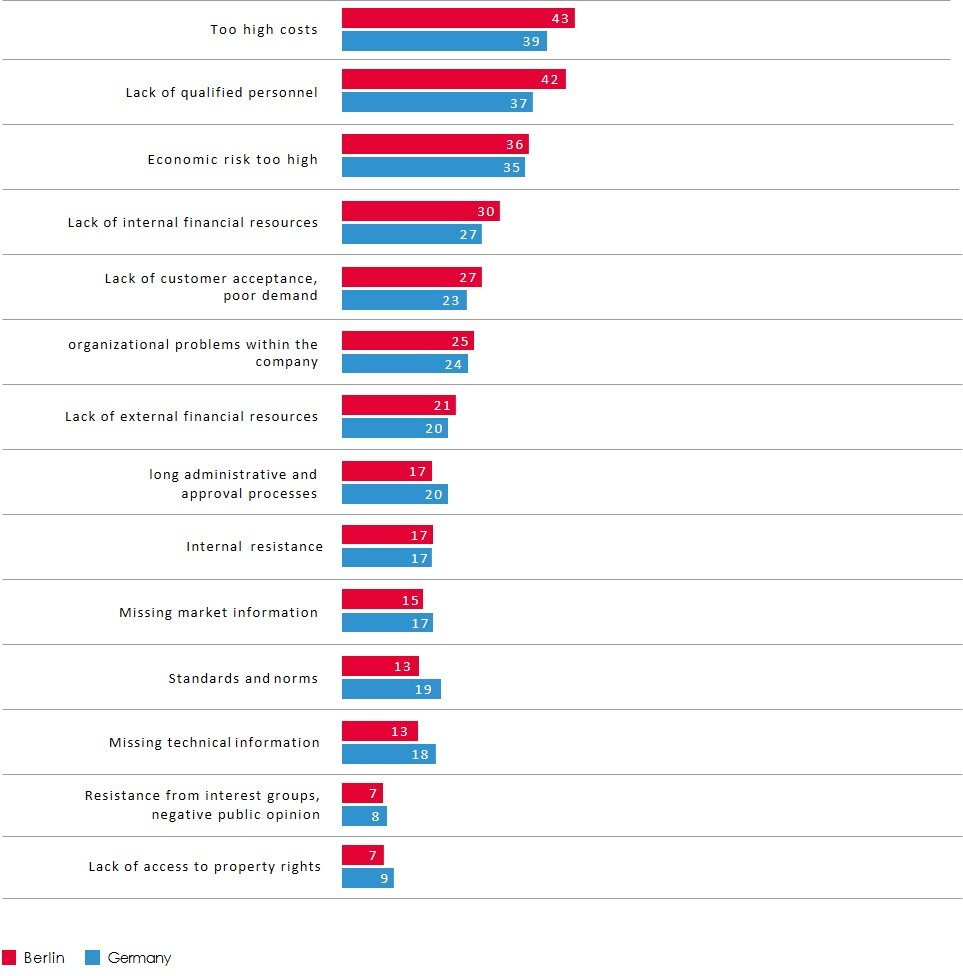

Knowledge and technology transfer were the main focus of the 2019 survey. This includes statistics on innovation partnerships, channels of access to knowledge and technology, the use of patents, and obstacles to innovation. The innovation behavior of Berlin’s economy is largely similar to that of Germany as a whole. The differences lie mainly on a sectoral basis rather than on a regional one. Innovation partnerships are traditionally very important for the Berlin innovation system. This is mainly due to the geographical proximity to universities and research institutes, which are therefore the most important cooperation partner for Berlin’s companies (fig. 4). Apart from direct cooperation, access to knowledge takes place to a large extent via a variety of platforms and media. To access this third-party knowledge, Berlin’s companies rely on typical elements of digitalization such as open source, open innovation, and social media much more intensively than the German average (fig. 5). This behavior is particularly strong in some sectors (e.g. digital service providers), in other sectors it is not. The lack of access to knowledge was rarely named as a barrier to innovation (fig. 6).